The value of alcoholic beverage exports in 2020 is Approx. 71 billion yen to reach a record high for the ninth consecutive year.

Whisky exports totaled 27.1 billion yen and whisky overtook sake to take the top spot for the first time.

Although the food and beverage industry and tourism-related industries were in a difficult situation due to the impact of the new coronavirus, the alcoholic beverage export business showed a solid growth of 107.5% over the previous year.

1. FY2020 Alcoholic Beverage Export Value by Category

| Item | Export value (thousand yen) |

Year on year (%) |

| Whisky | 27,114,790 | 139.4 |

| Sake | 24,141,070 | 103.1 |

| liqueur | 8,622,553 | 133.9 |

| Beer | 5,772,283 | 63.0 |

| Gin & Vodka | 2,018,900 | 59.3 |

| Shochu | 1,201,303 | 77.0 |

| Wine | 347,709 | 196.3 |

|

Other |

1,811,371 | 73.2 |

| Total | 71,029,979 | 107.5 |

Whisky overtook sake to take the top spot. The export volume is 127.9% of the previous year’s level, which indicates a situation where the unit price per unit is increasing as in the previous year.

2. FY2020 Alcoholic Beverage Export Destinations (by Country) Value

| Rank | Rank last year | Country |

Export value (million yen) |

Year on year (%) |

| 1st place |

No.2 ↑ |

China |

17,292 | 170.9 |

| 2nd place | No.1 ↓ | United States of America | 13,840 | 88.4 |

| 3rd place | No.3 → | Hong Kong | 9,975 | 159.5 |

| 4th place | No.4 → | Taiwan | 6,541 | 105.5 |

| 5th place | No.7 ↑ | Singapore | 3,829 | 111.2 |

| 6th place |

No.8 ↑ |

France | 3,185 | 92.6 |

| 7th place |

No.6 ↓ |

The Netherlands | 3,062 | 84.9 |

| 8th place | No.9 ↑ | Australia | 2,617 | 114.2 |

| 9th place | No.5 ↓ | South Korea | 1,919 | 31.2 |

| 10th place | No.16 ↑ | Russia | 1,282 | 337.4 |

China overtook the U.S. to take first place, with 170.9%.

The U.S. dropped a significant 88.4% from the previous year. The main reasons for the decline in the U.S. were Beer up 54.3% , gin/vodka up 41.2% .The slowdown was largely due to the slowdown in the

South Korea dropped sharply to 31.2% y/y. The impact of “beer” accounting for the majority of liquor exports to Korea was significant, with the value of Japanese beer exports to Korea peaking in 2018 at approximately 7.9 billion yen; in 2019, the value dropped sharply to approximately 4 billion yen due to the boycott campaign, and in 2020 it fell further to 0.5 billion yen.

This was largely due to the Japanese government’s tightening of export controls on South Korea in August 2019, which led to a boycott of Japanese products such as “beer” in South Korea, which further aggravated the situation in 2020.

The boycott movement was not limited to the alcoholic beverage industry; the closure of the UNIQLO Myeongdong Central Store in Korea in early December 2020 was major news.

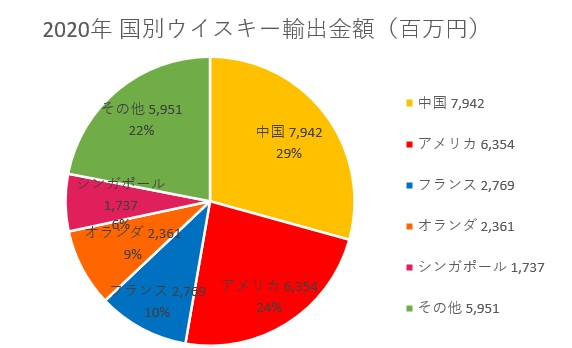

3. 2020 Value of Whisky Export Destinations

| Rank | Rank last year | Country | Export value (millions of yen) | Year on year (%) |

| 1st place | No.3 ↑ | China | 7,942 | 314.2 |

| 2nd place | No.1 ↓ | United States of America | 6,354 | 117.7 |

| 3rd place | No.2 ↓ | France | 2,769 | 101.0 |

| 4th place | No.4 → | Netherlands | 2,361 | 97.1 |

| 5th place | No.5 → | Singapore | 1,737 | 122.4 |

| 6th place | No.6 → | Taiwan | 1,025 | 79.8 |

| 7th place |

‐ |

Russia | 954 | The |

| 8th place | No.8 → | Australia | 726 | 127.6 |

| 9th place | No.9 → | Hong Kong | 672 | 186.7 |

| 10th place | No.10 → | Korea | 281 | 137.7 |

4. Considerations and Summary

Whisky has overtaken sake as the top export by value.

This is due to the dramatic leap forward in China, with the growing popularity among wealthy Chinese and the Japanese food boom, which has led to the opening of more Japanese restaurants and an increase in the number of restaurants using Japanese ingredients. Another reason is the soaring resale price of Japanese whisky in China, and the reduction of import tariffs on whisky from 10% to 5% in 2017 is also a factor.

Japanese whisky is becoming increasingly popular not only in China, but also in other Asian countries and the rest of the world, especially for high-priced vintage and limited edition products.

5. Whisky Trends in Japan

The leading whisky released in 2020 was Suntory’s Yamazaki 55 years old That is.

The lottery sale of 100 bottles, limited to 3.3 million yen including tax, is still fresh in our memories.

The Chichibu distillery released “Chichibu 10-Year Old The First Ten” as its first 10-year product, and the first release of the 24 Season series “Kanro” from the Akkeshi distillery was another first release from craft distilleries.

Major Japanese whiskys released in 2020

| Maker/Distillery | Brand name | Release Date |

| Suntory Limited |

Yamazaki 55years Yamazaki 2020 EDITION 5 kinds |

Jun. Nov. |

| Nikka | Yoichi, Miyagikyo Apple Brandy Wood Finish | Mar. |

|

Hombo Brewery |

Tsunuki the First | Apr. |

|

Venture Whisky Chichibu Distillery |

Chichibu 10 years old The First Ten | Nov. |

| Akkeshi Distillery |

Saronkamui, an Akkeshi Whisky Akkeshi Single Malt Whisky Kanro |

Feb. Oct. |

| Gaia Flow Shizuoka Distillery | Prologue K | Dec. |

| Kanosuke Distillery | Kanosuke Newborn 2020 Peated | Sept. |

| Saburomaru Distillery | Saburomaru 0 THE FOOL | Nov. |

| Helios Brewery | Xudian Cask Strength 2020 | Dec. |

While there was a flurry of releases from various distilleries, Nikka is planning to release the 17-, 21-, and 25-year vintages of the Taketsuru 17-, 21-, and 25-year vintages in March 2020, as well as the Sold out The company announced the With this, there are no more vintage whiskies in Nikka’s regular lineup.

New craft distillery in operation in 2020.

Hikari Shuzo, Konosu Distillery

Tokuyama Corporation, Igawa Distillery

Ide Brewery, Fuji Hokuroku Distillery

Lastly: Recommended Books on Japanese Whisky

If you want to learn more about Japanese whisky, which is a global trend, we highly recommend these books.

(1).Whisky Galore Vol.29 December 2021 issue

In the December 2021 issue of Whisky Galore, published by the Whisky Culture Research Institute, we report on 11 Japanese craft distilleries, including some that are open to the public for the first time, under the title of “Japanese Whisky Craft Frontline,” the first of three consecutive issues. Why did the popularity of Japanese whisky and the craft boom occur? We will examine with interviews. Chichibu Distillery / Chichibu No.2 Distillery / Mars Shinshu Distillery / Mars Tsunuki Distillery / Kanosuke Distillery / Hioki Distillery / Ontake Distillery / Osuzuyama Distillery / Kaikyo Distillery / Hanyu Distillery / Konosu Distillery

(2). Japanese Whisky as an Education for Business

This is a book written by Mamoru Tsuchiya, a world-famous whisky critic and representative of the Whisky Culture Research Institute, titled “Japanese Whisky as a Culture that Works for Business” .

The book covers the basics of whisky, the introduction of whisky to Japan, the birth of Japanese whisky, advertising strategies and the rise of Japanese whisky, and the current rise of craft distilleries. This is a book that summarizes Japanese whisky in a very easy to understand way.

(3). Whisky and I (Masataka Taketsuru)

Masataka Taketsuru, the founder of Nikka Whisky, devoted his life to brewing whisky in Japan. This is a revised and reprinted version of the autobiography of a man who simply loved whisky and talked about himself. The book vividly depicts the days when he went to Scotland alone to study as a young man and overcame many hardships to complete Japanese whisky, as well as his companion, Rita.

(4). A Letter of Challenge from a New Generation Distillery

Launching in 2019. With the world experiencing an unprecedented whisky boom, what were the managers of craft distilleries thinking and what were their thoughts as they took on the challenge of making whisky? This book tells the stories of 13 craft distillery owners, including Ichiro Hido of Venture Whisky, famous for his Ichirose Malt, who inspired the birth of craft distilleries in Japan.

(5). Whiskey Rising

This is the Japanese version of Whisky Risng, published in the US in 2016, with much updated content. Not only does it describe the history of Japanese whisky in detail, but it also includes data on all the distilleries in Japan, including the craft distilleries that have been founded in recent years. The book also includes descriptions of the legendary bottles that have been released, as well as information on bars where Japanese whisky can be found.