The value of alcoholic beverage exports in 2019 amounted to approximately 66 billion yen, reaching a record high for the eighth consecutive year.

In particular, whisky and gin/vodka exports continued to grow at an unstoppable pace, with a significant increase over the previous year.

1. 2019 Alcoholic Beverage Export Value by Category

| Item | Export value (thousand yen) |

Year on year (%) |

| sake | 23,412,129 | 105.3 |

| Whisky | 19,450,914 | 129.9 |

| Beer | 9,165,267 | 71.2 |

| liqueur | 6,440,115 | 113.5 |

| Gin & Vodka | 3,402,355 | 154.1 |

| Shochu | 1,560,092 | 102.0 |

| Wine | 177,151 | 63.0 |

|

Other |

2,475,233 |

120.6 |

| Total | 66,083,256 | 106.9 |

Whisky rose close to sake.

Gin, which rose significantly last year, settled down a bit to 114.8% year-on-year. “Vodka” led the way with a 509.7% year-on-year increase, albeit with a smaller denominator.

2. 2019 Alcoholic Beverage Export Destinations (by Country) Value

| Rank | Rank last year | Country |

Export value (million yen) |

Year on year (%) |

| 1st place |

No.1 → |

United States of America |

15,662 |

119.5 |

| 2nd place | No. 3 ↑ | China | 10,117 | 154.7 |

| 3rd place | No. 5 ↑ | Hong Kong | 6,253 | 107.4 |

| 4th place | No. 4 → | Taiwan | 6,198 | 104.9 |

| 5th place | No. 2 ↓ | South Korea | 6,151 | 55.6 |

| 6th place | No. 8 ↑ | The Netherlands | 3,607 | 145.5 |

| 7th place | No. 7 → | Singapore | 3,443 | 109.4 |

| 8th place | No. 6 ↓ | France | 3,440 | 103.2 |

| 9th place | No. 9 → | Australia | 2,292 | 95.2 |

| 10th place | No. 10 → | Vietnam | 1,927 | 105.3 |

China moved up to second place, growing at 154.7% year over year, close to the U.S.

South Korea’s 55.6% year-on-year growth can be attributed largely to the impact of the Japanese government’s tightening of export controls on South Korea in August 2019, which led to a boycott of “beer” and other Japanese products in South Korea.

The impact of “beer” accounting for the majority of liquor exports to South Korea was significant, with the value of Japanese beer exports to South Korea peaking at about 7.9 billion yen last year in 2018; in 2019, the value dropped sharply to about 4 billion yen due to the boycott campaign.

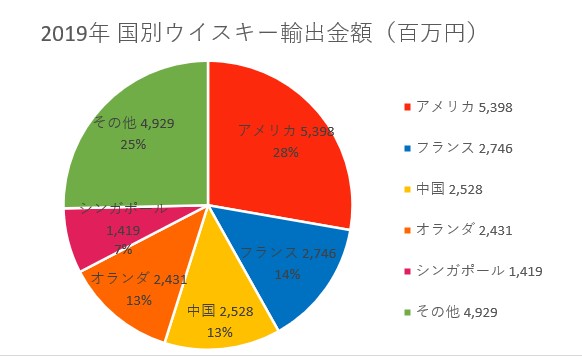

3. 2019 Whisky Export Destination Value

| Rank | Rank last year | Country | Export value (million yen) | Year on year (%) |

| 1st place | No. 1 → | United States of America | 5,398 | 130.0 |

| 2nd place | No. 2 → | France | 2,746 | 98.8 |

| 3rd place | No. 6 ↑ | China | 2,528 | 215.9 |

| 4th place | No. 3 ↓ | The Netherlands | 2,431 | 164.1 |

| 5th place | No. 5 → | Singapore | 1,419 | 113.7 |

| 6th place | No. 4 ↓ | Taiwan | 1,284 | 98.6 |

| 7th place |

No. 7→ |

Vietnam | 1,004 | 131.6 |

| 8th place |

No. 8 → |

Australia | 569 | 120.0 |

| 9th place |

No. 9 → |

Hong Kong | 360 | 119.2 |

| 10th place | No. 10 → | Korea | 204 | 158.1 |

4. Discussion and Summary

Whisky rose at a rate approaching that of sake.

Japanese whisky is further expanding its popularity worldwide, with a particular trend toward higher-priced products.

The top 10 whisky export destinations showed significant year-on-year increases (except France and Taiwan). Among them, China (215.9%) and the Netherlands (164.1%) made great strides. As a result, China was the only country that improved its ranking. China moved up three places to close in on second-place France.

5. Domestic whisky trends

In 2019, representative whiskies released in Japan include Nikka’s Yoichi/Miyagikyo Limited Edition 2019, Akkeshi Newborn Foundation 3 and 4 from the Akkeshi Distillery, and Kanosuke Newborn 2019 from the Kanosuke Distillery.

In October, Venture whisky’s Chichibu No. 2 distillery began operations. With five times the production of the first distillery, it made headlines.

In November, the Ouzuyama distillery in Miyagi Prefecture began producing whisky.

In Kagoshima Prefecture, Nishi Shuzo’s Mitake distillery also began operations in 2019.

It was also during this period that craft distilleries were scheduled to be built one after another in various parts of Japan.

Lastly: Recommended Books on Japanese Whisky

If you want to learn more about Japanese whisky, which is a global trend, we highly recommend these books.

(1).Whisky Galore Vol.29 December 2021 issue

In the December 2021 issue of Whisky Galore, published by the Whisky Culture Research Institute, we report on 11 Japanese craft distilleries, including some that are open to the public for the first time, under the title of “Japanese Whisky Craft Frontline,” the first of three consecutive issues. Why did the popularity of Japanese whisky and the craft boom occur? We will examine with interviews. Chichibu Distillery / Chichibu No.2 Distillery / Mars Shinshu Distillery / Mars Tsunuki Distillery / Kanosuke Distillery / Hioki Distillery / Ontake Distillery / Osuzuyama Distillery / Kaikyo Distillery / Hanyu Distillery / Konosu Distillery

(2). Japanese Whisky as an Education for Business

This is a book written by Mamoru Tsuchiya, a world-famous whisky critic and representative of the Whisky Culture Research Institute, titled “Japanese Whisky as a Culture that Works for Business” .

The book covers the basics of whisky, the introduction of whisky to Japan, the birth of Japanese whisky, advertising strategies and the rise of Japanese whisky, and the current rise of craft distilleries. This is a book that summarizes Japanese whisky in a very easy to understand way.

(3). Whisky and I (Masataka Taketsuru)

Masataka Taketsuru, the founder of Nikka Whisky, devoted his life to brewing whisky in Japan. This is a revised and reprinted version of the autobiography of a man who simply loved whisky and talked about himself. The book vividly depicts the days when he went to Scotland alone to study as a young man and overcame many hardships to complete Japanese whisky, as well as his companion, Rita.

(4). A Letter of Challenge from a New Generation Distillery

Launching in 2019. With the world experiencing an unprecedented whisky boom, what were the managers of craft distilleries thinking and what were their thoughts as they took on the challenge of making whisky? This book tells the stories of 13 craft distillery owners, including Ichiro Hido of Venture Whisky, famous for his Ichirose Malt, who inspired the birth of craft distilleries in Japan.

(5). Whiskey Rising

This is the Japanese version of Whisky Risng, published in the US in 2016, with much updated content. Not only does it describe the history of Japanese whisky in detail, but it also includes data on all the distilleries in Japan, including the craft distilleries that have been founded in recent years. The book also includes descriptions of the legendary bottles that have been released, as well as information on bars where Japanese whisky can be found.