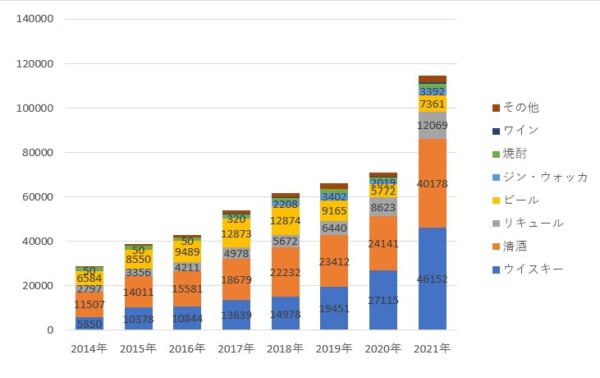

The value of liquor exports in 2021 will beApprox. 114.7 billion yen (161.4% compared to the previous year) up, reaching a record high for the 10th consecutive year.

whisky exports totaled approximately 46.2 billion yen (170.2% over the previous year), further outpacing sake (166.4% over the previous year). The difference between the two was approximately 6 billion yen.

Whisky export volume: 136.0% of the previous year’s level. It is the category with the largest “discrepancy between volume and value” among all alcoholic beverages, meaning that higher-priced products tend to be exported in greater quantities each year.

1. FY2021 Alcoholic Beverages Export Value by Category

| Item | Export value (million yen) |

Year on year (%) |

| whisky | 46,152 | 170.2 |

| Sake | 40,178 |

166.4 |

| Liqueur | 12,069 | 140.0 |

| Beer | 7,361 | 127.5 |

| Gin/Vodka | 3,392 | 168.0 |

| Shochu | 1,746 | 145.4 |

| Wine | 687 | 197.6 |

|

Other |

3,083 | 170.2 |

| Total | 114,688 | 161.4 |

The momentum of whisky exports has continued unabated, and even on a single month basis, exports have exceeded those of the same month of the previous year for 19 consecutive months since June 2020.

2. FY2021 Alcoholic Beverage Export Destinations (by Country) Value

| Rank | Rank last year | Country |

Export value (million yen) |

Year on year (%) |

| 1st place |

No. 1 → |

China |

32,025 | 185.2 |

| 2nd place | No. 2 → | United States | 23,811 | 172.0 |

| 3rd place | No. 3 → | Hong Kong | 14,758 | 148.0 |

| 4th place | No. 4 → | Taiwan | 9,307 | 142.3 |

| 5th place | No. 6 ↑ | France | 5,748 | 180.5 |

| 6th place |

No. 5 ↓ |

Singapore | 5,067 | 132.3 |

| 7th place | No. 8 ↑ | Australia | 4,193 | 160.2 |

| 8th place | No. 7 ↓ | Netherlands | 3,878 | 126.6 |

| 9th place |

No. 9 → |

South Korea | 2,763 | 144.0 |

| 10th place | No. 16 ↑ | Macau | 2,030 | 1267.6 |

While the top four countries did not change in ranking, all of the top 10 countries experienced significant increases over the previous year.

China, with 185.2% year-on-year growth, further outpaced lower-ranked countries, including the U.S.

Since the beginning of 2021, the situation of “boycott of Japanese products” which had continued until last year, has changed in South Korea, to the extent that “anti-Japanese fatigue” has become a keyword within the country. Imports of Japanese beer and other products changed to a recovery trend. As a result, the anti-Japanese boycott movement is easily heated and cooled Temporary Trends The view has changed to one that it was a radical boycott and that it is considered risky to conduct business activities in South Korea due to the extreme boycott.

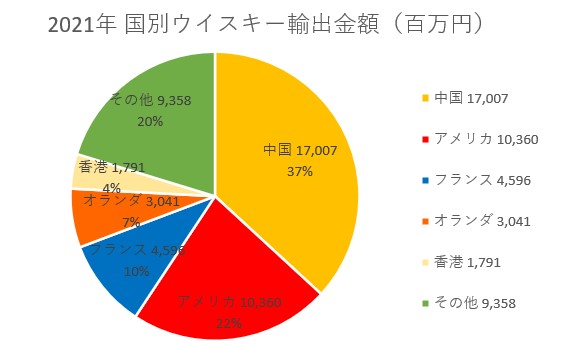

3. 2021 whisky Export Destination Value

| Rank | Last Year Rank | Country | Export value (million yen) | Year on year (%) |

| 1st place | No. 1 → | China | 17,007 | 214.1 |

| 2nd place | No. 2 → | United States | 10,360 | 163.0 |

| 3rd place | No. 3 → | France | 4,596 | 166.0 |

| 4th place | No. 4 → | Netherlands | 3,041 | 128.8 |

| 5th place | No. 9 ↑ | Hong Kong | 1,791 | 266.5 |

| 6th place |

No. 5 ↓ |

Singapore | 1,745 | 100.5 |

| 7th place | No. 6 ↓ | Taiwan | 1,536 | 150.0 |

| 8th place |

Out of rangeup ↑ |

Macau | 1,304 | – |

| 9th place | No. 8 ↓ | Australia | 1,187 | 163.5 |

| 10th place | Out of rangeup ↑ | Vietnam | 563 | – |

4. Considerations and Summary

Continuing from last year, whisky topped the list in terms of export value.

All of the top 10 whisky exporting countries saw year-on-year increases.

In addition, the value of whisky exports to China has been increasing significantly year after year: 1,171 million yen in 2018 (274.2% of the previous year), 2,528 million yen in 2019 (215.9% of the previous year), and 7,942 million yen in 2020 (314.2% of the previous year), indicating that the great strides made by China continue unabated. The number of companies is still increasing.

17,007 million this year compared to fiscal 2018.1452.3% increase and the growth has been phenomenal.

The reason for the popularity of Japanese whisky in China is that the Japanese “tradition of craftsmanship” and “dedication with the spirit of a master craftsman” are highly valued, and its “delicate and clean” characteristics compared to Scotch match those of the Chinese.

Another reason is the soaring resale price of Japanese whisky in China, which is also a factor in the reduction of whisky import tariffs from 10% to 5% in 2017.

5. Domestic whisky trends

On February 16, 2021, the definition of Japanese whisky was finally established as a voluntary standard by the Japan Western Liquor Brewers Association.

This is a sign that Japanese whisky is ready for further development, protecting its value and reliability in the future.

For more details, please click here.

https://jpwhisky.net/2021/03/03/standardofjapanesewhisky/

Representative whiskys released in 2021 include Suntory’s Yamazaki Limited Edition 2021, Hibiki Blossom Harmony, Hakushu Peated 2021, and Hakushu Spanish Oak 2021.

Nikka’s Yoichi Non-Peated and Miyagikyo Peated.

Collaboration whiskys from Chichibu Distillery and Mars Shinshu Distillery through the exchange of original sake, as well as the second to fifth releases in the Nijushisekki series from Akkeshi.

From Hombo Brewery and Mars whisky, the Long-aged whisky aged for 30 years. The “Mars Malt Le Papillon Komatsu Takahide” was also a hot topic.

Major Japanese whiskys released in 2021

| Maker/Distillery | Brand name | Release Date |

| Suntory Ltd. |

Yamazaki Limited Edition 2021 Hakushu Peated 2021 Hakushu Spanish Oak 2021 Hibiki Blossom Harmony |

May Mar. Oct. May |

| Nikka |

Yoichi Non-peated Miyagikyo Peated |

September |

|

Hombo Brewery |

Komagatake x Chichibu MaltDuo Mars Malt Le Papillon, Takahide Komatsu |

Apr. Nov. |

|

Venture Whisky Chichibu Distillery |

Japanese Blended Limited Edition 2021 Chichibu & Komagatake Double Distilleries |

Apr.

Apr. |

| Akkeshi Distillery |

Akkeshi Blended Whisky Usui Akkeshi Single Malt Whisky Boshu Akkeshi Blended Whisky Shosho Akkeshi Single Malt Whisky Ritto |

Feb. May August Nov. |

| Gaia Flow Shizuoka Distillery |

Shizuoka Prologue W Shizuoka Contact S |

Jun. Nov. |

| Kanosuke Distillery |

Kanosuke 2021 First Edition Kanosuke 2021 Second Edition |

Jun. Nov. |

| Saburomaru Distillery |

FAR EAST OF PEAT FIRST BATCH FAR EAST OF PEAT SECOND BATCH Saburomaru 1 THE MAGICIAN |

Mar. Mar. Nov. |

| Nagahama Distillery |

INAZUMA Synergy Blend INAZUMA Extra Selected |

Mar. |

| Azumi Distillery | YAMAZAKURA Azumi Blended Malt | Nov. |

| Sakurao Distillery |

Single Malt Sakurao Single Malt Togouchi |

July |

| Helios Brewery |

Kyoda Single Cask 2021 |

Dec. |

[New craft distillery that started operation in 2021]

Hakkai Brewery, Niseko Distillery

Toa Shuzo, Hanyu Distillery (reopened after 20 years)

Niigata Small Scale Distillery, Niigata Kameda Distillery

Axus Holdings Rokkosan Distillery

Yamaga Distillery, Yamaga Distillery Co.

It seems certain that the explosive popularity of Japanese whisky in Japan and abroad is behind the increase in the number of distilleries year after year, such as the following.

Lastly: Recommended Books on Japanese Whisky

If you want to learn more about Japanese whisky, which is a global trend, we highly recommend these books.

(1).Whisky Galore Vol.29 December 2021 issue

In the December 2021 issue of Whisky Galore, published by the Whisky Culture Research Institute, we report on 11 Japanese craft distilleries, including some that are open to the public for the first time, under the title of “Japanese Whisky Craft Frontline,” the first of three consecutive issues. Why did the popularity of Japanese whisky and the craft boom occur? We will examine with interviews. Chichibu Distillery / Chichibu No.2 Distillery / Mars Shinshu Distillery / Mars Tsunuki Distillery / Kanosuke Distillery / Hioki Distillery / Ontake Distillery / Osuzuyama Distillery / Kaikyo Distillery / Hanyu Distillery / Konosu Distillery

(2). Japanese Whisky as an Education for Business

This is a book written by Mamoru Tsuchiya, a world-famous whisky critic and representative of the Whisky Culture Research Institute, titled “Japanese Whisky as a Culture that Works for Business” .

The book covers the basics of whisky, the introduction of whisky to Japan, the birth of Japanese whisky, advertising strategies and the rise of Japanese whisky, and the current rise of craft distilleries. This is a book that summarizes Japanese whisky in a very easy to understand way.

(3). Whisky and I (Masataka Taketsuru)

Masataka Taketsuru, the founder of Nikka Whisky, devoted his life to brewing whisky in Japan. This is a revised and reprinted version of the autobiography of a man who simply loved whisky and talked about himself. The book vividly depicts the days when he went to Scotland alone to study as a young man and overcame many hardships to complete Japanese whisky, as well as his companion, Rita.

(4). A Letter of Challenge from a New Generation Distillery

Launching in 2019. With the world experiencing an unprecedented whisky boom, what were the managers of craft distilleries thinking and what were their thoughts as they took on the challenge of making whisky? This book tells the stories of 13 craft distillery owners, including Ichiro Hido of Venture Whisky, famous for his Ichirose Malt, who inspired the birth of craft distilleries in Japan.

(5). Whiskey Rising

This is the Japanese version of Whisky Risng, published in the US in 2016, with much updated content. Not only does it describe the history of Japanese whisky in detail, but it also includes data on all the distilleries in Japan, including the craft distilleries that have been founded in recent years. The book also includes descriptions of the legendary bottles that have been released, as well as information on bars where Japanese whisky can be found.